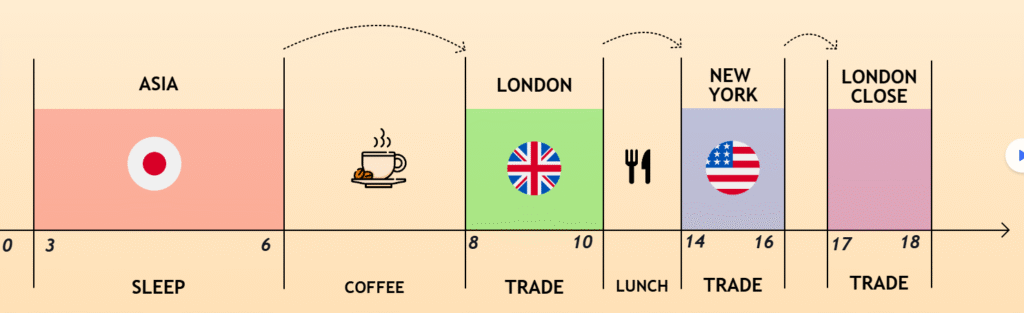

ICT Killzones refer to specific time windows during the trading day when the market experiences high liquidity, increased volatility, and smart money activity. These periods are carefully watched by traders because they often produce high-probability setups, making them ideal for short-term scalps or intraday trades.

ICT Killzones are not random—they align with major financial market openings and closings, where institutional players enter or exit positions, injecting significant movement into the market.

What are ICT Killzone times in GMT, UTC-4, and UTC-5?

Here’s a rewritten version of the paragraph:

The Inner Circle Trader Killzones times identify optimal trading windows across major forex sessions when institutional traders are most active. These strategic periods feature enhanced liquidity, volatility, and deliberate price movements, creating high-probability trading opportunities. Key Killzones occur during the Asian, London, New York, and London Close sessions, with specific timings mapped across GMT, UTC-4, and UTC-5 time zones.

| Killzone | GMT | UTC-4 ( EDT) | UTC-5 ( EST) |

|---|---|---|---|

| Asian KZ | 12:00 AM – 3:00 AM | 8:00 PM – 11:00 PM (Previous Day) | 7:00 PM – 10:00 PM (Previous Day) |

| London KZ | 7:00 AM – 10:00 AM | 3:00 AM – 6:00 AM | 2:00 AM – 5:00 AM |

| New York KZ | 1:00 PM – 4:00 PM | 9:00 AM – 12:00 PM | 8:00 AM – 11:00 AM |

| London Close KZ | 4:00 PM – 7:00 PM | 12:00 PM – 3:00 PM | 11:00 AM – 2:00 PM |

What is ICT Asian Killzone Time?

The Asian Killzone Time in trading refers to the critical time window between 7:00 PM and 10:00 PM EST, which coincides with the opening of the Tokyo forex market. In the ICT (Inner Circle Trader) methodology, this period is considered strategically important as it establishes the initial price range that institutional traders often leverage to manipulate prices during the subsequent London and New York sessions.

Asian Killzone Time Across Global Regions

| Country / Region | Time Zone | Killzone Start | Killzone End |

|---|---|---|---|

| New York (USA) | EST (UTC -5) | 7:00 PM | 10:00 PM |

| India | IST (UTC +5:30) | 5:30 AM (Next Day) | 8:30 AM (Next Day) |

| Nigeria | WAT (UTC +1) | 12:00 AM | 3:00 AM |

| South Africa | SAST (UTC +2) | 1:00 AM | 4:00 AM |

| Universal Time (UTC) | UTC | 12:00 AM | 3:00 AM |

Most Active Currency Pairs in the Asian Killzone

- USD/JPY – Most liquid during Tokyo hours; significantly influenced by Japanese economic data releases

- AUD/USD – Heavily traded due to Australia’s open market; responsive to commodity price movements

- NZD/USD – Similar to AUD/USD, moves with Asian-Pacific news and trade developments

- AUD/JPY – A volatile cross-pair ideal for scalping strategies during the Asian session

- EUR/JPY & GBP/JPY – These pairs can offer small breakout opportunities when liquidity spikes

Note: Major pairs such as EUR/USD, GBP/USD, and USD/CHF typically remain range-bound during this time unless impacted by unexpected news.

Key Characteristics of Asian Killzone Time

- Low volatility: Price tends to consolidate or range — excellent for establishing daily highs and lows

- Liquidity trap setups: Institutional traders often set up stop hunts before major trading sessions

- Market structure development: Frequently establishes support/resistance zones that influence London/NY trades

- Slower price movement: Ideal for precision entries but requires patience

- Higher spread risk: Some brokers widen spreads due to thin liquidity — traders should exercise caution

Average Pip Movements During Asian Killzone

While pip movements in the Asian Killzone are generally more modest, they can be highly predictable and valuable for:

- Scalping strategies

- Range trading approaches

- Pre-positioning for London breakout trades

Average Pip Movement During Asian Killzone

| Currency Pair | Average Pip Movement (Asian KZ) |

|---|---|

| USD/JPY | 30–50 pips |

| AUD/USD | 25–40 pips |

| NZD/USD | 20–35 pips |

| EUR/JPY | 30–45 pips |

| AUD/JPY | 35–50 pips |

What is ICT London Killzone Time?

The London Killzone Time is a crucial concept in the ICT (Inner Circle Trader) methodology, referring to the period between 2:00 AM and 5:00 AM EST when the London forex market opens. This time window is considered strategically significant as it often features increased volatility, liquidity surges, and price action that institutional traders (“smart money”) use to execute their trading strategies.

London Killzone Time Across Global Regions

| Country / Region | Time Zone | Killzone Start | Killzone End |

|---|---|---|---|

| London (UK) | GMT/BST (UTC +0/+1) | 7:00 AM | 10:00 AM |

| New York (USA) | EST (UTC -5) | 2:00 AM | 5:00 AM |

| India | IST (UTC +5:30) | 12:30 PM | 3:30 PM |

| Nigeria | WAT (UTC +1) | 8:00 AM | 11:00 AM |

| South Africa | SAST (UTC +2) | 9:00 AM | 12:00 PM |

| Kenya | EAT (UTC +3) | 10:00 AM | 1:00 PM |

| Universal Time | UTC | 7:00 AM | 10:00 AM |

Most Active Currency Pairs During London Killzone

- EUR/USD – The world’s most traded pair sees significant movement as European traders enter the market

- GBP/USD – “Cable” experiences heightened volatility during this period due to UK economic data releases

- EUR/GBP – This cross pair often exhibits strong directional moves during London open

- GBP/JPY – Known for its volatility, this pair can make substantial moves during London Killzone

- USD/CHF – The “Swissy” frequently shows notable price action as European markets open

Note: EUR and GBP pairs are particularly active during this session as European economic data and central bank announcements often occur during these hours.

Key Characteristics of London Killzone Time

- Market volatility spike: Price often makes sharp directional moves after the Asian range

- Stop hunts and liquidity runs: Smart money frequently targets areas of concentrated stop orders

- Order block formation: Creates significant supply and demand zones that influence later trading

- Technical breakouts: Asian session ranges often break during this period

- Volume surge: Sharp increase in trading volume as European institutional traders enter the market

- Manipulation tactics: Price often makes false moves before establishing the true daily direction

London Killzone Strategy Components

The ICT London Killzone strategy typically incorporates these key elements:

- Pre-London analysis: Identifying key levels established during Asian session

- Liquidity zones: Mapping areas where stop orders are likely concentrated

- Order blocks: Identifying institutional buying/selling areas for potential reversals

- Market structure: Analyzing higher timeframe bias before London open

- Volume profile: Monitoring unusual volume patterns during initial London hours

- Smart money concepts: Applying institutional trade flow concepts like breaker blocks and fair value gaps

Average Pip Movements During London Killzone

The London Killzone typically produces larger price movements than the Asian session, making it attractive for day traders and scalpers:

| Currency Pair | Average Pip Movement (London KZ) |

|---|---|

| EUR/USD | 50–80 pips |

| GBP/USD | 60–100 pips |

| EUR/GBP | 30–50 pips |

| GBP/JPY | 70–120 pips |

| USD/CHF | 40–70 pips |

London Killzone Trading Approach

Successful London Killzone trading typically involves:

- Overnight preparation: Analyzing price action during Asian session to identify key levels

- Early positioning: Entering positions before major price moves occur

- Stop placement: Strategic stop placement beyond likely manipulation points

- Liquidity targeting: Identifying where institutional traders will likely seek liquidity

- Risk management: Using appropriate position sizing due to increased volatility

- Session overlap awareness: Understanding dynamics as London session later overlaps with New York

Common London Killzone Chart Patterns

Traders should watch for these high-probability patterns during London Killzone:

- Asian range breakouts: Price breaking above/below the preceding Asian session range

- Liquidity sweeps: Quick moves beyond key levels followed by reversals

- Stop hunts: Sharp moves against the eventual daily direction

- False breakouts: Failed attempts to break key levels before true directional move

The London Killzone Time represents one of the most important trading windows in the 24-hour forex cycle, offering significant opportunities for traders who understand institutional money flow and can anticipate smart money movements during this volatile period.

What is ICT New York Killzone Time?

The New York Killzone Time is a key concept in the ICT (Inner Circle Trader) trading methodology. It refers to the critical period between 8:00 AM and 11:00 AM EST, marking the opening hours of the New York forex market. This window is strategically vital because it is the most liquid trading session globally, with substantial institutional participation and heightened volatility. Traders who understand the movements of smart money during this period can find prime trading opportunities.

New York Killzone Time Across Global Regions

| Country/Region | Time Zone | Killzone Start | Killzone End |

|---|---|---|---|

| New York (USA) | EST (UTC -5) | 8:00 AM | 11:00 AM |

| London (UK) | GMT/BST (UTC +0/+1) | 1:00 PM | 4:00 PM |

| India | IST (UTC +5:30) | 6:30 PM | 9:30 PM |

| Nigeria | WAT (UTC +1) | 2:00 PM | 5:00 PM |

| South Africa | SAST (UTC +2) | 3:00 PM | 6:00 PM |

| Australia (Sydney) | AEST (UTC +10) | 11:00 PM | 2:00 AM (Next Day) |

| Japan (Tokyo) | JST (UTC +9) | 10:00 PM | 1:00 AM (Next Day) |

| Universal Time | UTC | 1:00 PM | 4:00 PM |

Most Active Currency Pairs During New York Killzone

- EUR/USD — highest liquidity and strong moves during US economic data releases

- USD/JPY — active due to overlap between US and Japanese markets

- GBP/USD — volatile during London/New York session overlap

- USD/CAD — influenced by North American economic ties and data

- USD/CHF — responds strongly to US and European market news

- Gold (XAU/USD) — significant movement despite being a commodity

Note: The London-New York overlap (8:00 AM – 12:00 PM EST) is the most liquid and volatile trading period worldwide, offering the best trading opportunities.

Key Characteristics of New York Killzone Time

During the New York Killzone, the market is at its busiest, with more buyers and sellers trading at the same time than at any other point in the day, making it easy to enter or exit positions when you need to. Major institutions such as banks and hedge funds often choose this period to open or close large trades, which can send prices moving quickly in one direction or another. When important U.S. economic data is released, you’ll frequently see sudden spikes in volatility, as traders react to the news.

This session also serves as a test of the London session’s trend: if the price direction from London continues, the New York move will reinforce it, but if it reverses, you’ll often see a strong intraday change in direction. Sharp moves that trigger stop-loss orders—known as “stop runs”—are common, as smarter traders chase liquidity pools before launching the actual trend. You’ll also notice the appearance of large “blocks” of orders placed by institutions; these order blocks often act as magnets for price, influencing where the market turns next.

Average Pip Movements During New York Killzone

| Currency Pair | Average Pip Movement (NY KZ) | Movement on News Days |

|---|---|---|

| EUR/USD | 60–90 pips | 100–150+ pips |

| GBP/USD | 70–110 pips | 120–180+ pips |

| USD/JPY | 50–80 pips | 90–140+ pips |

| USD/CAD | 50–70 pips | 80–130+ pips |

| USD/CHF | 50–70 pips | 80–120+ pips |

What is ICT London Close Killzone Time?

The London Close Killzone Time is a pivotal concept in the ICT (Inner Circle Trader) methodology, referring to the period between 11:00 AM and 2:00 PM EST (4:00 PM to 7:00 PM GMT/BST). This time window coincides with the closing hours of the London forex market and represents a significant transition as European traders exit positions and liquidity begins to shift exclusively to New York. This period is renowned for its unique price action characteristics, institutional maneuvers, and high-probability trading opportunities.

London Close Killzone Time Across Global Regions

| Country / Region | Time Zone | Killzone Start | Killzone End |

|---|---|---|---|

| London (UK) | GMT/BST (UTC +0/+1) | 4:00 PM | 7:00 PM |

| New York (USA) | EST (UTC -5) | 11:00 AM | 2:00 PM |

| India | IST (UTC +5:30) | 9:30 PM | 12:30 AM (Next Day) |

| Nigeria | WAT (UTC +1) | 5:00 PM | 8:00 PM |

| South Africa | SAST (UTC +2) | 6:00 PM | 9:00 PM |

| Australia (Sydney) | AEST (UTC +10) | 2:00 AM (Next Day) | 5:00 AM (Next Day) |

| Japan (Tokyo) | JST (UTC +9) | 1:00 AM (Next Day) | 4:00 AM (Next Day) |

| Universal Time | UTC | 4:00 PM | 7:00 PM |

Most Active Currency Pairs During London Close Killzone

- EUR/USD – Often exhibits strong directional moves as European banks square positions

- GBP/USD – Frequently shows significant volatility as London traders close their day

- EUR/JPY – Can experience sharp retracements from London session trends

- GBP/JPY – Known for powerful reversals during this transition period

- USD/CAD – Often active as North American influences fully take control

- EUR/GBP – May show distinctive movements as cross-pair positions are adjusted

Note: European currency pairs (particularly EUR and GBP crosses) tend to show distinctive reversal or acceleration patterns during this period as European liquidity is withdrawn from the market.

Key Characteristics of London Close Killzone Time

- Position squaring: European traders close intraday positions, creating predictable flows

- Reversal potential: High probability of trend reversals from the London session direction

- Liquidity reduction: Declining market depth as European banks exit, creating volatility

- Stop hunting: Institutional traders often target stop-loss clusters before end-of-day

- Day’s range completion: Price often reaches the extremes of the daily range

- Volatility spike: Frequently exhibits a distinctive volatility signature as sessions transition

- End-of-day positioning: Banks establish overnight positions that influence Asian session

How Does Daylight Saving Time Affect ICT Killzones?

Daylight Saving Time (DST) affects ICT Killzones by shifting the clock forward or backward by one hour in regions that observe it. This means the start and end times of each Killzone move by one hour during DST, which usually begins on the second Sunday in March and ends on the first Sunday in November in the U.S. and many other countries.

| Killzone | Time Zone | Standard Time | Standard Time (UTC) | Daylight Saving Time (DST) | Daylight Saving Time (UTC) |

|---|---|---|---|---|---|

| New York Killzone | EST / EDT | 7:00 PM – 10:00 PM EST | 12:00 AM – 3:00 AM UTC | 7:00 PM – 10:00 PM EDT | 11:00 PM – 2:00 AM UTC |

| London Killzone | GMT / BST | 4:00 PM – 7:00 PM GMT | 4:00 PM – 7:00 PM UTC | 4:00 PM – 7:00 PM BST | 3:00 PM – 6:00 PM UTC |

| London Close Killzone | GMT / BST | 7:00 PM – 8:00 PM GMT | 7:00 PM – 8:00 PM UTC | 6:00 PM – 7:00 PM BST | 5:00 PM – 6:00 PM UTC |

Some Frequently Asked Questions (FAQ’s)

Why are ICT Killzones important?

These time windows are when smart money (institutions and banks) are most active. They create key price movements and liquidity grabs that offer opportunities for scalping, day trading, and swing entries.

How many pips can I expect during a Killzone?

On average, traders can expect 20–40 pips during active Killzones, though this varies by pair, session, and market conditions.

Does Daylight Saving Time affect ICT Killzones?

Yes, during Daylight Saving Time (typically March–November), ICT Killzone times shift one hour earlier in regions that observe DST, such as the U.S.

Which pairs work best during Killzones?

Asian Killzone: USD/JPY, AUD/USD, NZD/USD

London Killzone: GBP/USD, EUR/USD, EUR/GBP

New York Killzone: EUR/USD, GBP/USD, USD/CAD, USD/JPY

What happens outside of Killzones?

Markets are generally slower and less volatile outside Killzones. Price action may range or consolidate, offering fewer trade setups.